Our objective is to assist you in attaining top-notch grades in all the assignments. We have catered to thousands of students and we can help you also.

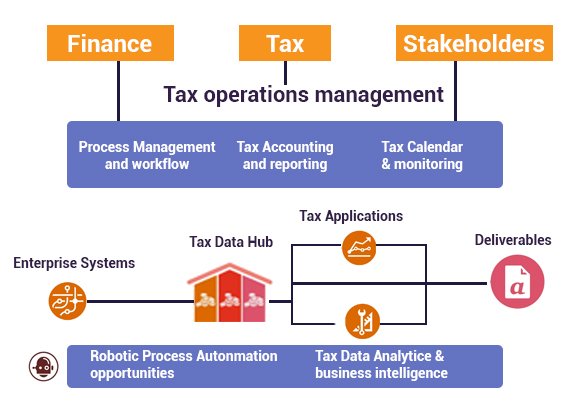

Digital break-down introduces worldwide touch, tie-up with customers and clients, business with tax authorities, tax operations with stakeholders. Hereby frame-up several working connections, market and business system and action towards worldwide financial resources.

The tax function is sharply going digital as well. Your organization needs to transform digitally, regulatory norms, protocol, and switching managerial economics figures with digitalization. Connected tax is another variant of tax, fundamentally rationalized, well-governed, and easier to understand data atmospheres that assist the wording, drive value, worth and reduce the risk for the corporation. Lessen the pressure of getting scammed in the name of tax with the official tax technology assignment help shared by the experts of BookMyEssay.

Tax technology and transformation (TTT) mechanisms are set up to guide innovation in performance, up-gradation of data and address the unknown and unexpected dares and opportunities. We bring together Tax assignment help and tax transformation action plans and blueprints and Technology professionals to support you in implementing a connected tax schedule and from development to full-scale alternation.

What Is Tax Technology?

In our eyeshot, text Technology adds any type of software, program, Digital tool that takes a side of tax processes in a digital form and renovates the job of tax professionals.

- Technology For The Tax Function: A mode of technique can be held in present-day tax behavior so far, and its eventual single choice will sustain to rise as time goes on. The officials work for the conversion of students’ weaknesses into their forte by consistently improving their tax technology assignment help.

- Robotic Process Automation (RPA): It is an effortless process. robotic process automation is assisted for the tax activities as manual, repetitive, and highly logical. Information and data entry is used for low-value tasks. The queries, doubts, misconceptions created by students’ minds will be resolved easily with the tax technology assignment help shared by the erudite of BookMyEssay.

- Smart Process Automation (SPA): It also stands for Intelligent Process Automation. SPA takes a step ahead with machine learning and automated workflow. We believe in working smartly rather than using outdated approaches that’s why renowned as the qualitative provider of tax technology assignment help.

- Artificial Intelligence: Tax technology also comes with AI tools that have advanced capability of data analysis and that will make the team's performance better.

- Cloud Computing: Tax departments are also go-off with cloud-based web applications that take advantage of control of data loss. Nowadays tax practices are appointing tax technology in almost every section of tax, utilizing each from tax management and data outcome to deed management, return spelling, forecasting, invoice paying, and more.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029