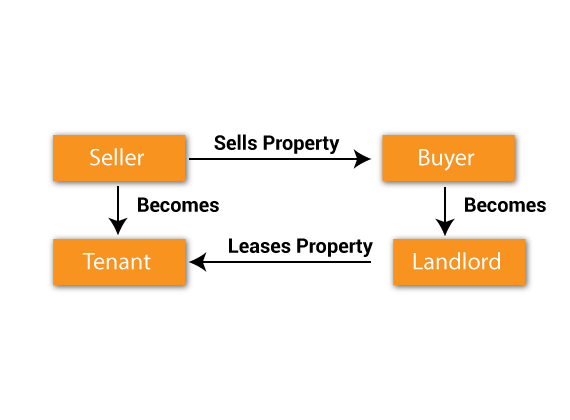

Sale and Leaseback of Non-Current Assets is a financial transaction that enables selling a non-current asset and taking it on lease. The transactions enable sellers to use an asset without owning it and simultaneously releasing a capital blocked by an asset. This kind of transaction is performed on mutual understanding of both parties.

What are the Key Benefits of Sale and Leaseback of Non-Current Assets?

The major benefits are discussed in our Sale and Leaseback of Non-Current Assets homework assignment help online as follows:

Instant cash injection: The major advantage is that it offers an instant cash injection into businesses. It removes the fluctuations risks involved in the future value of assets. This is a paper transaction and sellers continue to use the assets through this transfer process.

Enhanced working capital: Accessing working capital is a major advantage that makes it a popular decision for organizations that want to grow. When you sell a property that you own and then lease it back, you get liquidity. This transaction if done correctly can give you access to the ownership.

Financing the full investment: In bank loans, the investments are financed partially by the own funds of a company. The assets are valued by banks depending on loan-to-value calculations and thus they finance just 60-80 per cent of the buying costs. On the other hand, in Sale and Leaseback transactions, 100 per cent of the investment expenses are borne by lessors.

No financial covenants: Compared to conventional bank loans, it does not involve financial covenants, which need to be observed. Lessors get ownership rights when they buy the leased assets and becomes the lessor through a leasing contract, however not lenders.

Matching maturities: When investments are financed through classic bank loans, the life of an asset and credit period diverge. Due to this, loans are repaid regularly much before the end of the asset’s life, In this transaction, the imputed costs ad financing payments are balanced when a leasing period is selected.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029