The Importance of Dividend yield, Dividend cover, and a Price earnings ratio

The important is discussed in our Dividend Yield, Dividend Cover, Price/Earnings Ratio homework help online as follows:

Dividend yield is a parameter that is used for evaluating a company before buying its stocks. Investors use the trailing dividend yield ratio and forward dividend yield ratio for a better understanding of the dividend yield ratio of a company.

This ratio is different across industries. The industries including Electronics or IT have a negligible dividend yield, howver, FMCG and PSU have stable dividend yield. It must be noted that each company that has a high dividend yield is not worth investment. The ratio becomes attractive when the share’s market price falls. We have finance assignment help experts who provide an in-depth understanding of these ratios and help you to calculate the ratios accurately.

A Dividend coverage ratio enables analysts in evaluating the safety of a dividend of a company. Several investors focus on dividend yield, hoewever, do not give attention to its safety. Companies should create adequate cash flows to make payment of the expenses, service their debt, invest, and return the money.

If the Dividend Coverage Ratio is higher than 1, adequate earning is generated for serving shareholders with dividends. A DCR of more than 2 is good. A DCR consistently below 1.5 is a cause for concern. A deteriorating dividend coverage ratio signals poor profitability and it means a company might not be able to sustain the present level of dividend payout.

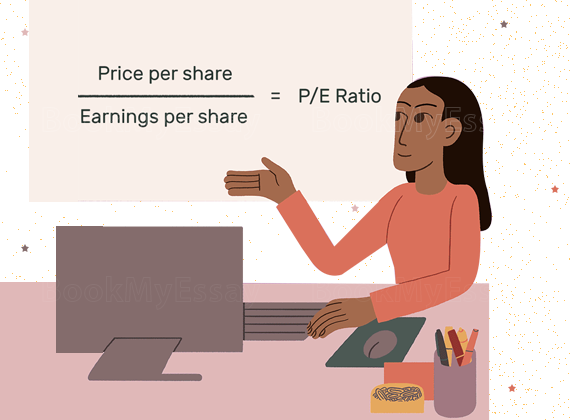

The Price/Earnings ratio is a financial ratio used widely by all organizations. This ratio helps investors for calculating the earnings of a company and the ratio is calculated is dividing the current market price of shares by earnings per share.

There are two kinds of PE multiplies, a Trailing PE and a Forward PE. The importance of a P/E ratio can be understood how expensive or cheap a stock is. If the ratio is lower then it provides a buying opportunity. A higher P/E indicates that an investor is paying more for every unit of income. A higher P/S indicates a good growth of the stock.

As highlighted by our Dividend Yield, Dividend Cover, Price/Earnings Ratio assignment help site in Australia, this ratio provides an idea regarding e future risk, growth, and past performances. When a company has a robust track record, it has greater PE and it is dependent on the company’s capital structure.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029