Commonly, debt factoring is a long-term arrangement as the factor turns included in the processes of business sales. When a business doesn’t wish to utilize a factor, then it can be a method of many months for ending the service.

Students always get fresh papers in place of copied content from us and this allures them to buy case study help on Debt Factoring related assignment from us.

Benefits of Debt Factoring

Invoice factoring proposes businesses a huge range of viable advantages, like debt protection, improved cash flow, and fast purchasing. These advantages aid your businesses to expand and lessen your reliance significantly on the upcoming payments. The below-mentioned list comprises a huge range of advantages like:

- The augmented flow of cash – Commonly, the mission of factoring is raising cash swiftly. This is a method of getting the cash that your customers are indebted to you minus waiting for them to finish the transaction actually. Hence, receiving cash injection for improving the flow of cash is the chief benefit of debt factoring.

- Lessen the cycle of cash flow – Numerous smaller businesses do struggle due to the normalized and expected time between order or work completion besides the making of the payment. This time lag does pose remarkable knock-on issues and one of the remarkable benefits of debt factoring is it can lessen that cycle besides getting payment.

- Capability to make fast purchase decisions – When you require to make supply purchases urgently besides getting new equipment or making repairs, factoring turns into a superb method of releasing the needed funds.

- Fast expansion – When you are presented with a chance to take on a lucrative order or a new client, then you might require expanding regarding capacity and staffing and in this aspect, debt factoring would be able to improve your working capital.

The writers of BookMyEssay are pretty popular in the world of academic writing because of their expert Debt Factoring assignment assistance and so, students always count on us when they need assignment help.

The Kinds of Debt Factoring

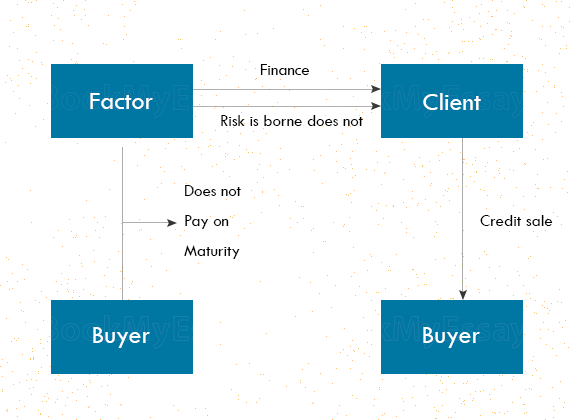

The two kinds of debt factoring are:

Recourse factoring – It is a common type of factoring and here, the financial institution does fund the portfolio of your accounts receivable.

Non-recourse factoring – This factoring works pretty similar to recourse but the difference lies in the non-recourse factoring’s appeal. When your customer can’t pay the invoice, then you retain the advance while the factor does take the loss.

Students always get customized papers from us and this is one of the reasons for which they seek Debt Factoring homework writing help from us.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029