This is always wiser to make comparisons of the current ratio of the company with other companies that belong to the same industry. Again, it is also wise to make comparisons of the recent current ratio of the company to its ratio. So, when you are stuck with problems and need essay help on Current Ration related topics, then you must take the assistance of our experts as they have got many years of experience.

Understanding of Current Ratio

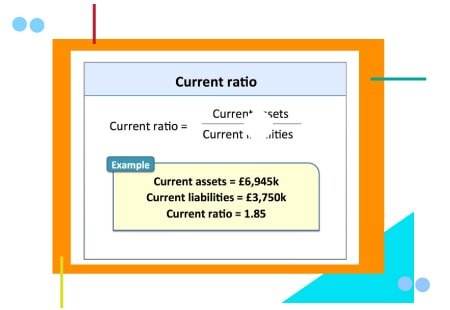

Commonly, the Current Ratio is used for giving an idea regarding the ability of the company for paying back its obligations with its assets. This can be useful for taking a rough measurement of the financial health of a company. When the current ratio is higher, then the company becomes more capable to pay its obligations because the company will possess a larger amount of asset value in comparison to its liabilities’ value.

The Current Ratio which is below one specifies that the liabilities of a company are greater compared to its assets and it also suggests that the company isn’t in a position for paying off its obligations when it becomes due during that point. It also signifies that the financial health of the company isn’t good. However, it doesn’t necessarily indicate that it will become bankrupt as there are numerous ways open to a company for accessing financing.

Students who buy assignment case study help with Current Ratio from us always get their assignments done and delivered within the stipulated timeframe and it keeps students away from botheration of any kind.

Utilizations of Current Ratio

The current ratio happens to be an indication of the market liquidity of a firm and its capability of meeting the demands of the creditors. The acceptable current ratios do vary from one industry to another and are commonly between 1.5 percent and 3 percent for a healthy business.

When the current ratio of the company happens to be in this range, then it commonly indicates excellent short-term financial strength. Again, when the current liabilities do exceed the current assets, then the company might be having issues in meeting its short-term requirements.

When students take Current Ratio assignment help online from us, they always get papers that are the result of extensive research and so, emerge as unique in every sense.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029