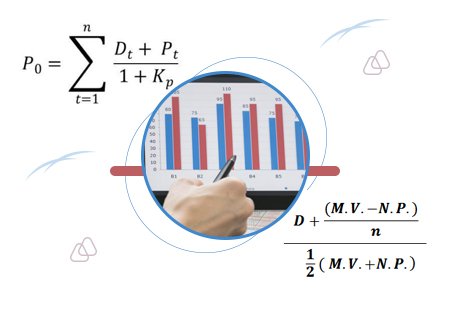

NP = Preference share capital – Discount – Cost of Flotation – Here, the cost of capital gets calculated based on the preference share capital directly but on the net that proceeds in the following way:

Kp = NP/Dividend – You can browse the definition, as well as meaning of more terms that have similarities with Cost of Preference Share Kp as the Management Dictionary, does cover more than 7000 business concepts and that too from six categories. And so, this definition plus concept has been researched and authored well.

Students love to contact us for getting help for assignment on Cost of Preference and Equity Capital because we always include aspects that should be included in an assignment.

What is Meant by Equity Capital?

Equity Capital is meant the funds that are paid to a business through the investors for preferred or common stock. It represents the central business funding to which you can add debt funding. When it is invested, then these funds become risky as the investors will never be repaid during corporate liquidation until and unless the claims of other creditors do not get settled.

In spite of all these risks, an investor still remains available to propose equity capital for one or more than one reasons that are mentioned below:

- Possessing enough number of shares provides an investor with some kind of control on the business where the investments have been made.

- An investee might periodically issue a dividend to its stockholders.

- The shares’ cost might become appreciated over time and so, an investor can sell his shares to make profits.

Advantages of Equity Capital

When you see from the perspective of accounting, then you will find that equity capital is a component of the equity section of the stockholders and it comprises the par value, retained earnings, extra paid-in capital besides the offsetting amount of treasury stock.

Again, when you see equity capital from the perspective of valuation, then it is viewed as the net amount of funds that would investors get when all the assets will be liquidated plus in the case where the corporate liabilities will be settled. In a few cases, it might turn out to be a negative figure as the company assets’ market value will be lower compared to the collective amount of liabilities.

Students always get their assignments done on time and so, they count on our Cost of Preference and Equity Capital homework assignment help.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029