The Best Practices for Core Systems Transformations

The best practices that should be implemented are discussed in our Core Systems Transformations homework writing help as follows:

Select a fit for purpose option: Insurance companies implement core system transformation for consolidation, extending, or rewriting a present system or to replace a system. The decision is based on investment budget, priorities, availability of skill/people, vendor solution, and organizational preparedness. Insurers should, however, choose the best transformation, which aligns with future plans, strategic priorities, and risk appetite.

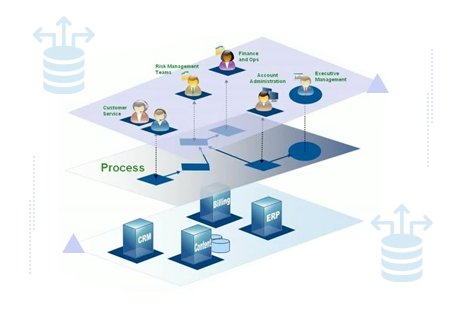

Buy-in of business sponsorship: Core system transformation is not only IT initiatives. IT is a major enabler change, however, the buy-in is important to success. IT and business should build an operating model. The business team plays an important role in the process definition.

Change management: As there are ongoing changes in the market or business conditions, regulatory norms, and customer preferences, there are requests to change/amend the original sequence and scope of a transformation program. A strong change management team is required to prioritize, govern, and implement the changes. It includes representation from IT owner, business sponsor, vendor, architect, and subject-matter experts.

Select the correct implementation partner: Insurers should validate the relevant experience of a vendor to implement a huge system transformation with a resource pool and skills availability. You have to split the program at least two vendors to remove the risk of vendor dependency. An in-depth product and vendor assessment is needed. We have been helping students with top-quality assignment writing assistance on Core Systems transformation that can help them secure top grades.

Assess execution risk constantly: Execution is an important aspect to deliver core system transformations and insurers should assess execution risk constantly and develop plans for mitigation. Besides cost, schedule, and risk tracking, it should focus on releases to gain acceptance. Many insurers though follow agile but a strong communication plan, governance structure, and defined responsibilities and roles are essential for seamless execution. Weekly, as well as monthly programs, should be published to cite dependencies, key milestones, open issues, and risks.

Clear on data migration plans: Insurers are too engrossed to define new system needs, architectural changes, and processes and they overlook critical data conversions and migration. Before beginning any change, insurers should decide on a cut-off date related to data conversion and build an approach to handle claims, active policies, assess data quality, and transactions. As stated by our Core Systems Transformations assignment help providers, insurers should work with vendors closely and evaluate the best migration plan.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029