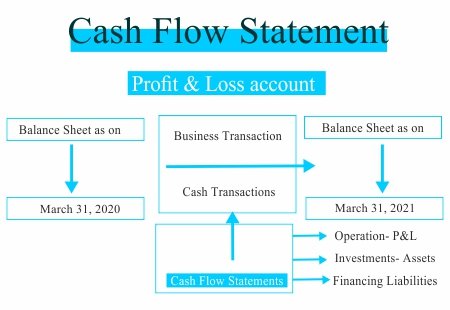

Components of Cash Flows:

The components of cash flows are discussed in our help for assignment with Cash Flows as Profit and Components of Cash Flows as follows:

Operating Activities

This section represents the cash received from the income statement reported primarily on an accrual basis. Some of the items that form part of this section include accounts payable, accounts receivable, and income tax payable.

When clients pay receivables, they are recorded as cash from operations. The changes in current liabilities or current assets are recorded as cash from operating activities.

Investing Activities

Cash flow from investing activities includes the sale proceeds from the sale of equity investment and debt, sale proceeds from the sale of fixed assets, and principal received from loans made. Investing activities include outflows for the acquisition of equity and debt, purchase of a fixed asset, and loans made to others.

Cash changes from investments are considered “cash outflows” as cash is used for purchasing buildings, equipment, and short-term assets. If an organization divests its assets, this transaction is referred to as “cash inflow.” Buy coursework help online on Cash Flows as Profit and Components of Cash Flows assignment in Australia by PhD experts at affordable prices

Financing Activities

Equity and debt transactions are included in this component. The cash flows include the sale or repurchase of stocks, payment of dividends, and bonds. These are considered the cash flow from financing activities. Cash used for paying long-term debts, cash received from taking loans are recorded in this part.

The investors who invest in dividend payment companies find this section important because cash dividends paid are showed. Net income is not used for the payment of dividends to shareholders.

Cash Flow and Profit

The relation between cash flow and profit are discussed by our Cash Flows as Profit and Components of Cash Flows assignment providers. Cash flow is the cash that flows in and out from the firm from financing, operations, and investing activities. This is the money you require for meeting present obligations.

If your business is profitable for a short-term period, you may thrive and survive only if you have cash for investing in the business and paying bills. To manage cash flow effectively, you have to necessarily pay taxes, run daily operations, purchase inventory, and pay costs. Profit, on the other hand, is an indicator of the actual money that is available to a business for a given time period.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029