Methods to Calculate Cash Flow

There are two methods to calculate cash flow; direct method and indirect method. These methods are discussed in our online help with assignment on Cash Flow Statement as follows:

Direct Cash Flow Method

In the direct cash flow method, all kinds of cash receipts and cash payments are added including the cash receipts from customers, cash paid in salaries, and cash paid to suppliers. The figures are calculated using the starting and the end balances of business accounts and then an examination of the net increase or decrease in accounts. We provide top-quality assistance to students when they ask, "write my case study for me on Cash Flow Statement."

Indirect Cash Flow Method

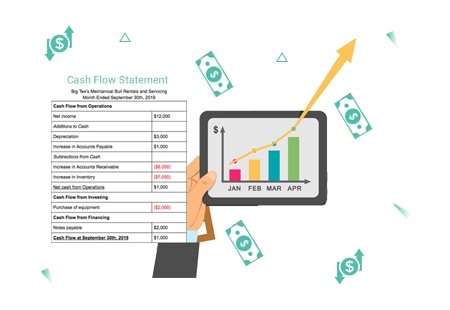

In an indirect method, cash flow from an operating activity is calculated considering the net income from the income statement of a company. The income statement is prepared on an accural basis and so revenue is recognized not when received but when earned. Net income does not represent the cash flow accurately and thus it is essential to adjust EBIT for those items that impact income though actual cash is not received or paid. This method makes adjustments for adding back non-operational activities, which do not affect the operating cash flow of a company.

In a cash flow statement, the operating section is shown either through the Direct Method or an indirect method. In both the methods, the financing and investing sections are similar, the difference is there in the operating section.

In the end, under the direct method as well as the indirect method, the cash flows from the operating activities shall show the same result though the presentation shall differ. More than 90 percent of companies use the indirect method. BookMyEssay writers are ready to provide you Cash Flow Statement research paper writing help you immediately through writing service.

What Does Cash Flow Statement Tell Us?

You can know many things from cash flow statement that is highlighted in our Cash Flow statement assignment help in Australia as follows:

- You can compare cash from operating activities to the net income of a company for determining the earnings. If it is greater than net income, the earnings are of high quality.

- The cash flow statement is helpful to investors because cash is the king and it enables investors to receive an overall view of the cash inflows and the cash outflows.

- If a company funds losses from financing or operating by raising money through equity or debt then it shows clearly on the cash flow statement.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029