Applications of Bayes’ Theorem are widespread and it is not limited to a financial realm. This theorem is used for determining the accuracy of medical test results. Its formula is used to know how an event’s probability can be affected by new hypothetical information. BookMyEssay provide detailed answers to all your assignment queries and offer a proper explanation to them. So, you ask us, “write my homework for me.”

Importance of Bayes’ Theorem

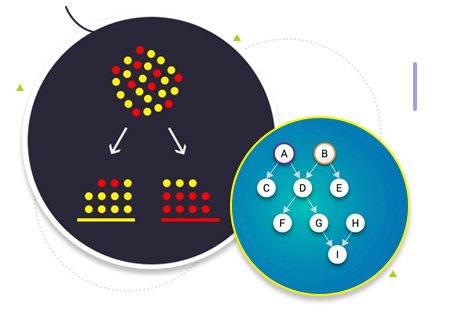

Bayes’ Theorem has many uses. This theorem leads you to the posterior probability of conditional probability. According to our Bayes’ Theorem and its Applications assignment providers, you can make use of previous experience, you can change the conditional probability into an important conditional probability.

Conditional probability is based on observed data and you can obtain it much easier compared to other probabilities that are based on prior knowledge and observed data. Bayes’ Theorem is used for combining any earlier experiences as prior probability along with observed data for interpreting these data. The process is known as Bayes’ Inference.

Mathematically, it can be shown that no other theorem can offer a better guess compared to Bayes’ Theorem, so it can be said a perfect guessing theorem.

Uses of Bayes’ Theorem in Finance and Business

Corporate finance specialists and business and finance people have been using Bayes’ Theorem for several centuries. The uses are highlighted in our applications of Bayes’ theorem assignment help online as follows:

Evaluating interest rates

Companies depend on interest rates due to various reasons- investing in the market, borrowing money, and trading in foreign currencies. Unexpected changes in rates of interest can hamper a company very hard and can impact its profits in a negative manner. With Bayes’ Theorem, companies can evaluate interest rates changes and help the companies to take advantage financially.

Net income

Businesses want to remain on the top of their income source and want to make profits after deducting their expenses. Net income is very vulnerable to outside events such as weather, legal proceedings, geopolitical events, cost of materials and equipment. Finding out probability from net income equation can make a string platform when you manage resources and make important decisions.

Extending credit

With Bayes’ Theorem, financial companies can make good financial decisions as well as can evaluate the risk to lend cash in a better manner to existing and unfamiliar borrowers. For instance, a client has a very good track record to repay loans but recently he has been very slow to pay. The additional information about loan repayment history based on probability may help the company in treating the slow payment as a red flag, it can either increase the rate of interest on a loan or reject it.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029